Rev. June 28, 2020

**This guidance has been extended and is effect for applications taken on or before July 31, 2020**

REMN Wholesale has modified our policy regarding appraisal inspection report types due to new guidance from FNMA and FHLMC. In response to COVID-19, reduced documentation may be permitted in certain circumstances. The below guidance provided is effective immediately for applications taken on or before May 17, 2020.

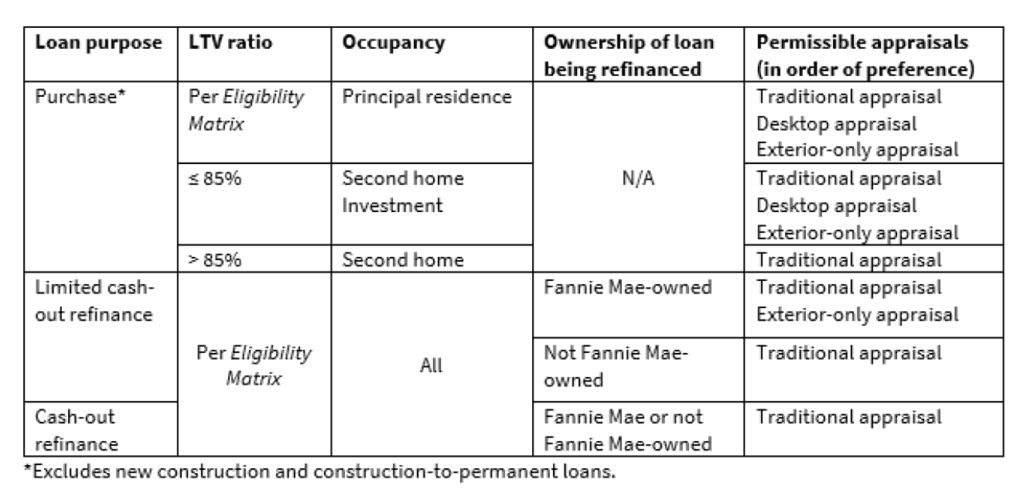

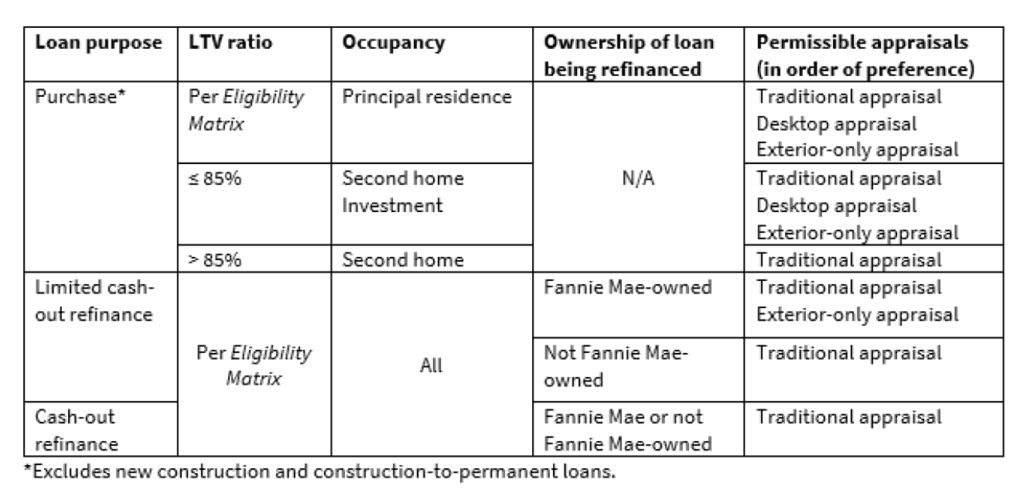

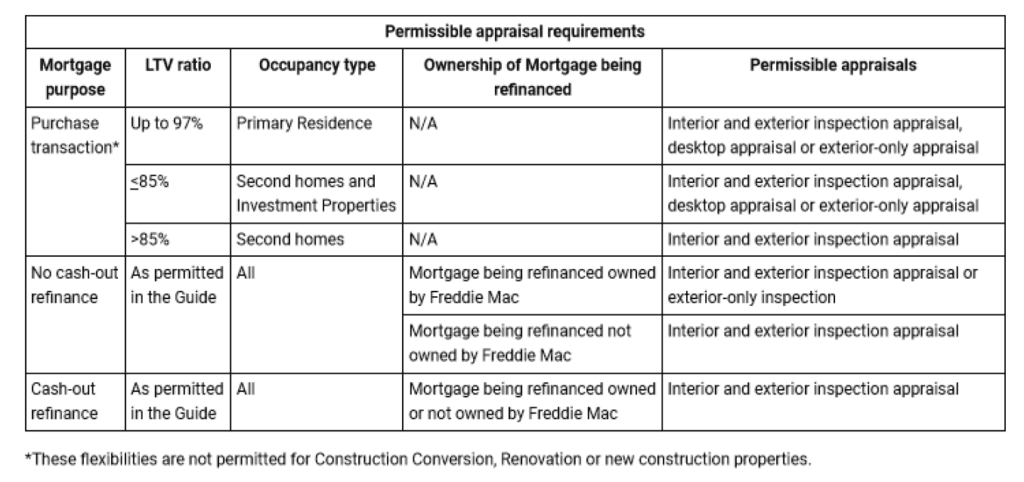

PURCHASE TRANSACTIONS

• All primary residences (per the maximum LTV eligibility matrices); all second and investment homes with an LTV equal to or less than 85.00%:

o Traditional appraisal – OR o Exterior only – OR

o Desktop appraisal

• All second and investment homes with an LTV greater than 85.00%

o Traditional appraisal ONLY

LIMITED CASH OUT – EXISTING LOAN IS OWNED BY EITHER FNMA OR FHLMC

• If the existing loan is owned by either FNMA or FHLMC (refer to lookup table links below)

o Traditional appraisal – OR

o Exterior Only

• Look Up Table:

o FNMA: https://www.knowyouroptions.com/loanlookup

o FHLMC: https://ww3.freddiemac.com/loanlookup/

LIMITED CASH OUT – EXISTING LOAN IS NOT OWNED BY EITHER FNMA OR FHLMC

• If the existing loan is NOT owned by either FNMA or FHLMC:

o Traditional appraisal ONLY

CASH OUT – REGARDLESS OF WHO OWNS THE LOAN

o Traditional appraisal ONLY

COMPLETION CERTIFICATIONS

• If the appraiser cannot gain access to the property, the following will be

acceptable to verify completion of required repairs – (HomeStyle not included)

o Borrower statement listing all repairs with their confirmation that work is

completed – AND

o Photographs that the work is completed OR paid invoices OR permit

approval OR other similar documentation

INELIGIBLE TRANSACTIONS

• Construction-perm and renovation loans are EXCLUDED from the appraisal documentation flexibility. Loans must have a traditional appraisal

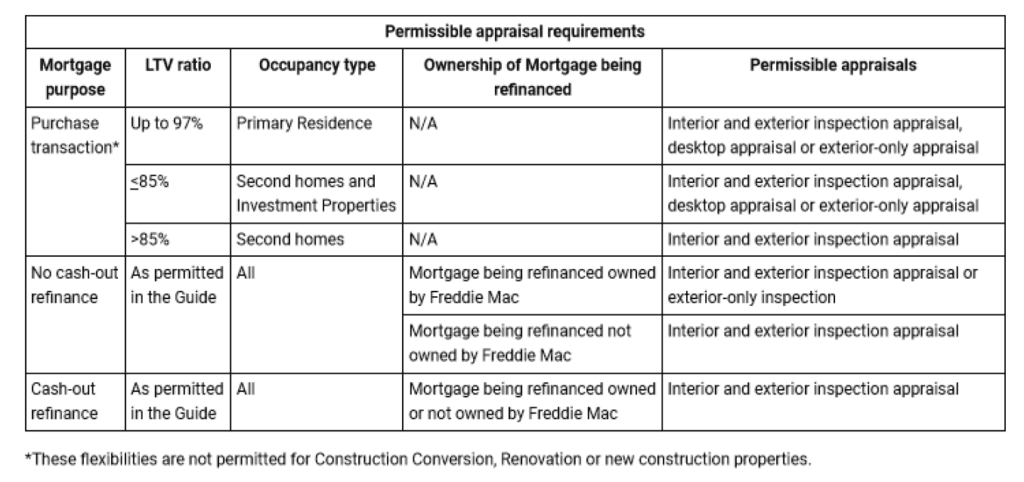

FNMA APPRAISAL GRID

FHLMC APPRAISAL GRID

FREQUENLY ASKED QUESTIONS

• WHO DETERMINES WHAT TYPE OF APPRAISAL SHOULD BE ORDERED?

o The Broker may determine what type of appraisal is required based upon

the new guidance outlined above. In addition, the Underwriter will also

specify in the condition which appraisal types are allowed (in case the

Broker has not already ordered the appraisal)

o If an exterior only or desktop appraisal is requested, but the appraiser

feels it cannot be completed due to inadequate information, the broker can

submit a help desk ticket. Management will decide if there is another

solution or advise if traditional report is required

• WHAT IS THE DIFFERENCE BETWEEN AN EXTERIOR AND A DESKTOP

APPRAISAL?

o Desktop Appraisal Requirements

▪ Forms 1004, 1073, 1025, 1004C as applicable

▪ Photos of subject property

▪ Inspection of subject/comparable not required

▪ Location map showing the location of the subject and comparables

o Exterior-only Appraisal Requirements

▪ Forms 2055,1075, 1025, 1004C as applicable

▪ Photos of subject property

▪ Location map showing the location of the subject and comparables

• DOES THE BROKER NEED TO DO ANYTHING DIFFERENT WHEN

ORDERING THE APPRAISAL?

o Please be specific with the AMC when ordering which inspection type you are requesting. The AMC cannot take responsibility to determine the type of appraisal that is required based upon loan characteristics

• WHAT DOES THE BROKER DO WITH EXISTING ORDERS?

o If a traditional appraisal was ordered and the loan is now eligible for an

exterior or desktop appraisal, the broker can make the change directly

with the AMC. Please note – if inaccurate changes are made REMN will

not be responsible

• DOES REMN HAVE A PREFERENCE ON THE TYPE OF APPRAISAL?

o If a traditional is not available to be obtained, our preference would be first a Desktop (if allowed by property type) and then an Exterior

• WHAT IF A TRADITIONAL APPRAISAL IS REQUIRED AND THE SELLER

AND/OR BORROWER WILL NOT LET THE APPRAISER IN THE HOME?

o Unfortunately, if a traditional appraisal is required, access is needed in

order to complete the appraisal

• DOES IT MATTER IF THE LOAN IS ALREADY APPROVED OR NOT?

o No. These new options are available regardless of underwriting status as

long as the appraisal hasn’t already been submitted to REMN Wholesale

• FOR LIMITED CASH OUT WHERE THE LOAN IS OWNED BY EITHER FNMA OR FHLMC – IS THAT “INTERCHANGEABLE”?

o No. If the loan qualifies for the abbreviated appraisal as the loan is

currently owned by either FNMA or FHLMC, the new loan must “match”

the agency. If the existing loan is owned by FNMA the new loan must be a

FNMA product. If the existing loan is owned by FHLMC the new loan must

be a FHLMC product

• WHAT IF THE APPRAISER STATES THAT A TRADITIONAL APPRAISAL IS REQUIRED?

o Ultimately the appraiser must determine that he/she has enough

information in order to provide a valid Exterior Only or Desktop

Appraisal. If the appraiser believes there is insufficient information to

complete these abbreviated reports, a traditional appraisal report will be

required

• WHAT ABOUT APPRAISAL WAIVERS?

o Ultimately the AUS engine will determine if an appraisal waiver is

permitted. If permitted, existing guidelines regarding appraisal waivers

remain in place

• WHAT IF MY LOAN HAS MORTGAGE INSURANCE?

o Mortgage Insurance providers are aware of the new appraisal guidelines

and have given no indication they are not adhering to these new appraisal

flexibilities. REMN Wholesale will confirm the applicable MI company will

accept the appraisal option selected. Ultimately REMN must follow the

decision the MI company makes regarding accepting an appraisal

inspection type

If you have additional questions, please contact your Account Executive.